Artificial lift providers are responding to lowe oil prices and the pressure to reduce costs by introducing new technology and processes that increase efficiency, improve reliability and lower initial and operating costs.

By Eldon Ball Executive Editor

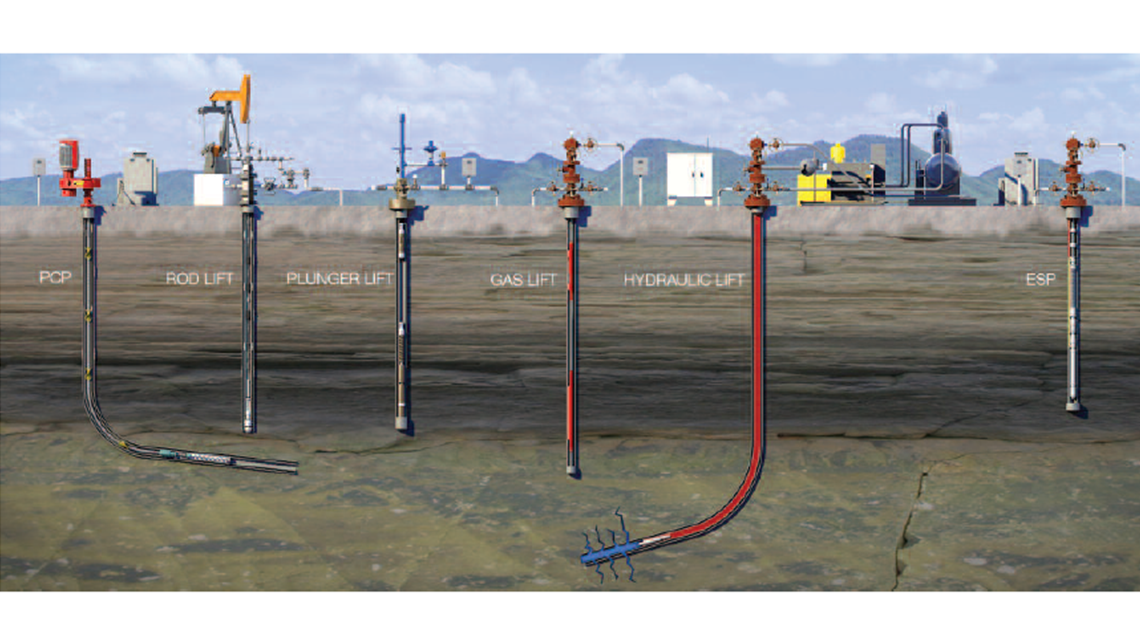

Source: Hart Energy Artificial Lift Techbook

Providers strive for improvements in sand control, gas separation, flow range expansion and automation.

Artificial lift providers are responding to lowe oil prices and the pressure to reduce costs by introducing new technology and processes that increase efficiency, improve reliability and lower initial and operating costs. New technology is focusing on expansion of flow and pressure ranges, designs that will be better handle increasingly difficult fluids, automation, sand control and integration of Artificial Lift systems with other forms of preoduction activities. Recognizing the growing demand for Artificial Lift from the unconventional market, Schlumberger put together a full-cycle Artificial Lift offering and has added a number of new technological advances. ¨Two and a half years ago, we put together a strategy to address ther trends of the industry, with those trends being unconventional or shale wells and the production challenges that were associated with them,¨ said Kyel Hodenfield, Schlumber president of Artificial Lift for North America. ¨Shale wells tipically have a steep production decline. They produce a mixed flow of gas, water and oil, which is difficult, and they produce sand, which is also very difficult. Often, there are corrosion issues and scale issues. And all of those are an unfriendly environment to Artificial Lift. What we wanted to do was to bring the right solutions to each well for each client. ¨We didn´t necessarily have the full offering, so we looked at an acquisition strategy for complete well flow management.

As the industry becomes more competittive, it was really critical that we could help our clients achieve their production targets in the most economical way. This required more than just having ESPs [electric submersible pumps] and gas lift". Over the period of 18 months, Hodenfield said Schlumberger acquired 16 companies with locations all over North America and globally. "This really helped us become more engaged with the customer after the well had been completed," Hodenfield said. "But is not really about these companies and hardware but about offering a total solution to the client. It's part of an overall strategy for Schlumberger in the unconventional environment, where we utilize measurements of the reservoir to the drilling, well placement, completion and fracturing process the well cleanup for flowback, and then on into production. Previously, the first completion would have been the extent of our solution, but now eith these acquired companies, we will have engagement with our client for the production life cycle of that well. For unconventional wells, this is often targeted to be 30 to 40 years." Schlumberger is able to advise the client, based on production forecast, whether they should initially use an ESP, for instance, or start off with a rodlift system, Hodfield said," It is very important to take a look at what the client priorities are, because you can have two clients right accross a lease line from each other, and one may be considering an enhanced oil recovery strategy from the initial completion. It's really about understanding what the customer's requirements are, how they want to produce reservoir, and then selecting the right system to meet their requirements." Even though the oil price has resulted in a reduction in drilling for many operators, the market for rod-pump maintenance and repair and for rod pumps for new wells remains consistent, said Richard Webb, Artificial Lift manager at DistributionNOW. "Our primary core business is to serve sucker tod pump shops," Webb said." We have 40 shops in the U.S. which is more than any other company, and we have an additional 22 in Canada. We just got approval to open up our 41st shop in the U.S. for the Niobrara Shale in Fort Lupton, Colo. We have concentrated on expanding into the shale plays over the past five years. We have tripled our business in servicing rod pumps in the Eagle Ford each of the last three years, just because South Texas was not a traditional rod pump play. It had mostly gas wells." Development of fluids lifting in the Eagle Ford also has led to new business, Webb said. "A lot of the players that moved into the Eagle Ford came in from offshore, and the operators didn't have experience with rod pumps, so it's been a training ground. We've done a lot of schools on rod-pumping systems. We'll do probably 15 to 20 more this year. The Training covers how to extend rod-pump life. What's most important for the customer now is not the initial cost of the pump, because it's so miniscule comparatively speaking, but keeping it downhole and keeping the whole system working. That's really the concentration in the industry now, with the hotizontal wells -keeping it in the hole and gas separation."